Updated: 22nd January 2022

Pandemic Unemployment Payment

Since 22 January 2022, PUP is closed to new applicants.

The PUP scheme will end on 25 March 2022 with the last payment on Tuesday, 29 March 2022.

December 2021 update:

The COVID -19 Pandemic Unemployment Payment scheme was closed to new applicants in July 2021, but it will reopen for a limited time to support people who lose their employment as a result of the new COVID-19 public health restrictions from Tuesday 7th December 2021.

The COVID-19 Pandemic Unemployment Payment (PUP) is open to you if you are an employee or self-employed and lost your job due to the COVID-19 pandemic.

Applications should be made online through the MyWelfare.ie portal.

The PUP now has five rates:

The top rate will be €350 and will be available to those earning €400 or more a week.

Those who received wages between €300 and €399 prior to being laid off will be entitled to €300.

There will be a €250 rate payable to those who were earning €200-€299, and €203 to those in the €151.50-€200 bracket.

A new rate of €150 will be paid to those who had previously been earning less than €151.50.

Existing PUP claimants:

The weekly payment rate will reduce by €50 on the following dates:

- 7 September 2021

- 16 November 2021

- 8 February 2022

If the reduced PUP payment is less than the jobseekers payment or other social welfare income supports that a person qualifies for, they will get the higher payment.

- For more information about PUP click HERE

- To apply for the PUP please get your staff to use the MyWelfare service HERE

Employment Wage Subsidy Scheme (EWSS)

Update: 22nd January 2022

On 21 December 2021, the Government announced an extension of the EWSS scheme. If you are ineligible under the current scheme you may be able to re-enter the scheme from the 1 January 2022.

You can re-enter the scheme if you expect to suffer a 30% decrease in turnover or customer order values in December 2021 and January 2022 versus December 2019 and January 2020.

If your business commenced after 1 May 2019, you should compare the average monthly turnover of December 2021 and January 2022 to the average monthly turnover or customer order values from August to November 2021.

Subsidy rates

The subsidy amount paid to you will depend on the gross income of each employee. The EWSS will give a flat-rate subsidy to you, based on the number of qualifying employees on your payroll.

It was announced on 22nd January 2022 that for businesses (pubs) directly impacted by the public health restrictions, the following changes will apply:

- The graduated step-down in subsidy rates will be delayed by one month.

- Businesses will continue to receive the enhanced rates of subsidy for February.

- A two-rate structure of €151.50 and €203 applies for March.

- A flat rate subsidy of €100 applies for April and May.

- The reduced rate of Employers’ PRSI will no longer apply for these 2 months.

- The EWSS will end on 31 May 2022.

What is the EWSS

It is effectively a subsidy to pay the wages of employees. There are two parts to it

· It provides a flat rate subsidy to qualifying employers based on numbers of paid and eligible employees on the payroll, and

· It charges a reduced rate of employers PRSI of 0.5% on wages paid which are eligible for the subsidy payment

How is it paid?

It is administered by Revenue on a “self-assessment basis”. It is paid directly into the employer’s bank account once a month in arrears.

Do I have to register?

Yes. You must register and any application for payment filed without prior registration will be automatically rejected.

How do I register?

You register through the ROS system. Registration will only be processed if the employer is registered for PAYE/PRSI as an employer, has a bank account linked to that registration and has tax clearance.

PRSI

A 0.5% rate of employer’s Pay Related Social Insurance (PRSI) will continue to apply for wages paid to 28 February 2022 that are eligible for the subsidy.

You must report and apply the full rates of employer and employee PRSI as normal. On receipt of payroll submissions, Revenue will apply a reduced rate of 0.5% employer’s PRSI for eligible employees for whom a subsidy is payable.

Revenue will revise monthly employer PRSI liabilities accordingly.

Can I employ new people and claim EWSS for them?

Yes

Proprietary Directors

EWSS can be claimed on behalf of proprietary directors if they are on the payroll. Sole traders can claim the EWSS for their employees but, as sole traders cannot be an employee of himself / herself they cannot be on the payroll and cannot claim EWSS on their own behalf.

Connected Parties

A connected party is defined as a brother, sister, linear ancestor, linear descendent, aunt, uncle, niece, nephew of an individual or their spouse. Connected parties would have had to be on the payroll at some stage between July 1st 2019 and June 30th 2020 to qualify. You may not claim for a connected party that has been added to the payroll outside of these dates.

Suspension of Right to Claim Redundancy Extended

The Minister also secured government approval to extend the redundancy provisions relating to temporary lay-off and short-time work, which arose as a result of Covid-19 until September 30th, 2021. Section 29 of the Emergency Measures in the Public Interest (Covid-19) Act 2020 temporarily reduced the scope of the operation of the Redundancy Payments Act 1967 by the addition of Section 12A to the Redundancy Payments Act which permitted those on a period of layoff or short time, (for 4 weeks or more, or for 6 weeks in the last 13 weeks), to give notice of their intention to claim for redundancy from their Employer. It is important to note that the Employee’s right to claim redundancy has not been removed but rather deferred for the emergency period in circumstances of temporary lay-off or short-time employment.

As of end September 2021 this suspension is lifted.

Re-opening your Business & Covid Pandemic Unemployment Payment (PUP)

Once you re-open your business or re-commence employment you should stop your Covid payment claim on your first day back at work.

You can stop your payment online HERE

22nd January 2022 update –

The following is our understanding of the situation based on the guidelines.

Because of early removal of restrictions on Jan 22nd the current claim period will be shortened to two weeks. If you have claimed and been paid already for three weeks that results in an overpayment of one week.

Moving on, you are now entitled to claim for a ‘restart week’ for your first week fully re-opened.

This should be done on ROS eRepayments system by ticking the relevant box and making the required declarations.

The restart week amount will net off against the overpayment.

Your turnover in the current restart week (commencing Jan 24th) is not relevant to your CRSS or restart week claims.

The situation may be different for a business which could not claim for the first claim period commencing 20th Dec, and whose first claim was therefore for period commencing 10th Jan. They may not be eligible for a ‘restart week’ as a condition for eligibility is that they must have been claiming CRSS for a continuous period of at least three weeks prior to restrictions ending.

21st December 2021 update – The Covid Restrictions Support Scheme (CRSS) is where eligible businesses can make a claim to Revenue for a payment known as an Advance Credit for Trading Expenses (ACTE). An ACTE is payable for each week a business is affected by the restrictions.

The CRSS is expected to continue until 31 January 2022.

The ACTE is equal to 10% of the average weekly turnover of the business in 2019 up to €20,000, plus 5% on turnover over €20,000. In the case of new businesses established between 26 December 2019 and 26 July 2021, the turnover is based on the average actual weekly turnover in a reference period, which depends on when the business was established. The ACTE is subject to a maximum weekly payment of €5,000.

How to make a claim

A two-step process is necessary to make a claim under COVID Restrictions Support Scheme (CRSS). The eligible business must both:

- register for CRSS on Revenue Online Service (ROS)

- complete a claim in respect of a claim period or claim periods.

Restart Grant

As of November 2021 all businesses should have claimed for a Restart Grant.

The Government provides for an enhanced restart week payment – a single payment of three double week to businesses upon re-opening (subject to a maximum of €30,000).

To be eligible the business must be recommenced within a reasonable period of the lifting of restrictions (July 26th). By reasonable period it is meant that the business is about to commence its activities or has already recommenced its activities.

The restart week is the equivalent of three weeks double CRSS. Example – a business is currently getting €500 per week on CRSS – the restart week is equal to €3,000.

Eligible businesses in the hospitality, entertainment and night-time economy sectors which cease to be significantly restricted from operating from 22 October 2021, on being allowed to reopen to provide services, may make a claim for the triple “restart week” payment referred to above from 25 October 2021.

How do I claim the restart week?

The claim can be made on the claim portal in respect of CRSS which is available via the eRepayments system on ROS. There are 4 requirements:

- Details of the Claim – Only 1 restart claim should be made. The system will automatically calculate the payment due and issue one single payment

- Provide bank details

- Requirement for a declaration as follows

‐ Acknowledgement that as a recipient of the CRSS, the name under which the businessactivity is carried on, a description of the business activity and the address, includingEircode, of the business premises, will be published on the website of the Revenue Commissioners;

‐ A declaration that the return is correct and complete;

‐ A declaration that the person intends to recommence trading within a reasonable period

of time from the date on which the applicable Covid public health restrictions are lifted;

‐ A declaration that the business will repay the restart week if they do not recommence

trading within a reasonable period of the restrictions lifting.

- Sign and submit

The claim must be made no later than 8 weeks from the date on which the restrictions, to which the restart week claim relate, are lifted.

Business Resumption Support Scheme (BRSS)

As the economy re-opened, a further scheme was introduced for vulnerable but viable businesses, particularly in sectors that were significantly impacted throughout the pandemic, even during periods when restrictions were eased.

Businesses whose turnover was reduced by 75% in the reference period (1st September 2020 to 31st August 2021) compared with 2019 are eligible could make a claim for the BRSS.

The BRSS is administered by Revenue and operates in a similar way to CRSS.

Applications under the scheme had to be submitted between early September 2021 until 30 November 2021.

Full details of the scheme and how to apply are here https://www.revenue.ie/en/self-assessment-and-self-employment/brss/scheme-rates.aspx

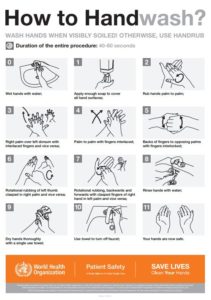

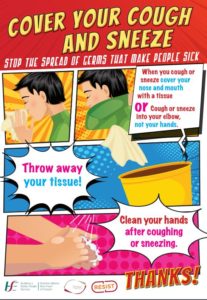

In advance of reopening all staff must complete Covid-19 training before they can recommence work. We have secured an industry-leading customised training course for all our members at no cost to you. It is very simple to use and only takes 20 minutes to complete click HERE

Employees who are laid off are entitled to public holiday payment for 13 weeks after they have ceased working.

Please consider the following Q&A:

Q: Is it still necessary to have worked 40 hours in previous five weeks (to be entitles to public holiday payment)? If so, does this refer to the last five weeks before layoff?

A: Calculations are based on the five weeks immediately preceding layoff.

Q: If entitled to a benefit how can this be paid when employee is claiming social welfare (i.e COVID Emergency payment) as you are not allowed to process any payroll for them or they will be cut off from benefit. Is it carried forward until they return to work?

A: Public holiday entitlements will be paid on either resumption of employment OR as part of final payment if made redundant

Q: What about employees not working but retained on payroll with the Revenue Wage Subsidy Scheme with or without top-up. Is the 40 hour requirement still applicable?

A: Although employees are not working they are still employed and as such are arguably entitled to benefit for Public Holiday. For full time employees who are on the wage subsidy and receiving full top up, if they were due to work the public holiday Monday, they aren’t required to work and they still get their normal pay.

Obviously, there are part time/casual staff who are not rostered for public holidays and hence the 1/5 of their normal working week calculation would apply.

Q: Why pay staff an additional benefit if they are already getting paid time off?

A: Technically they are not on paid time off but are restricted by their employer, by virtue of the fact of a Governmental order, from attending work.

Tax Owed- The Finance Minister has confirmed that staff paid through the wage subsidy scheme won’t have to repay any tax they owe until 2023.

Supports

On 1 June 2021, the Government launched the Economic Recovery Plan 2021. As part of the measures announced in the Economic Recovery Plan, the Minister for Finance confirmed that the period of time during which tax debts can be warehoused will be extended until the end of December 2021 for all eligible taxpayers, and that the scheme would be extended to cover overpayments of the EWSS.

1) Debt Warehousing of certain VAT and PAYE (Employer) taxes

‘Debt Warehousing’ means VAT and PAYE relating to the period of COVID-19 closure will be ‘parked’ at zero interest rate for a further 14-15 months after re-opening.

The tax periods for which liabilities can be warehoused commence in Jan 2020 for VAT, and from Feb 2020 for PAYE. The next two-monthly VAT period after opening is also included.

All tax returns during the closure must have been filed as normal. Inclusion in the scheme is automatic for Small to Medium Enterprises (SMEs).

After the 12 month period you can enter a Repayment Plan which will be at a rate of only 3% interest. The repayment period is negotiable.

Tax Clearance will not be affected by availing of warehousing arrangements.

Examples:

Pub opens June:-

Tax periods warehoused

VAT

January 1st 2020 to August 31st 2020

PAYE

February 1st 2020 to August 31st 2020

12 month zero interest phase

September 1st 2020 – August 31st 2021.

Reduced Interest Phase – 3% interest on COVID-19 liabilities

September 1st 2021 until liabilities paid in full.

Pub opens September:-

Tax periods warehoused

VAT

January 1st 2020 to December 31st 2020

PAYE

February 1st 2020 to December 31st 2020

12 month zero interest phase

January 1st 2021 – December 31st 2021.

Reduced Interest Phase – 3% interest on COVID-19 liabilities

January 1st 2022 until liabilities paid in full.

2) Reduced interest rate for outstanding ‘non-COVID-19’ tax debts

The Government also announced a reduced interest rate of 3% per annum to apply to tax debts that cannot be warehoused, i.e. older liabilities for taxes of all types, provided the taxpayer concerned enters into a phased payment agreement with the Collector-General before 30 September 2020.

The 3% rate represents a significant reduction from standard interest rates on late payment of taxes of 8% – 10% per annum.

If you have any outstanding tax issues please contact your tax advisor immediately to ensure you can avail of this offer before it expires.

Further information and guidance on both measures is outlined in the information booklet:

- Information booklet on debt warehousing and reduced rate of interest for outstanding ‘non-COVID-19’ debts.

Guinness is running the Raising the Bar Helpline, a dedicated freephone support phoneline for pub owners, their staff and their immediate families affected by the COVID-19 crisis. The service is being financed as part of the €14 million Raising the Bar fund established by Guinness this summer.

The helpline is staffed by a team of counsellors and finance experts in Ireland, Monday to Friday, from 9am to 5pm. To ensure that calls continue to be answered, even out of hours, there are counsellors available to take calls 24 hours a day, 7 days a week, ensuring that contact can be made at any time and any relevant follow up scheduled. The phone number for the helpline is

1800 303 589 (direct dial: (0)12612734) and can also be reached by text or email. All details can be found on www.MyDiageo.com

Guinness is launching the Raising the Bar Helpline to provide support to callers in the context of the COVID 19 pandemic by providing emotional counselling and information regarding financial supports available to them.

The government has published the Return to Work Safely Protocol, which is designed to support employers and workers to put measures in place that will prevent the spread of COVID-19 in the workplace.

You can access the document HERE

Measures set to be introduced include employers having to ensure their employees answer a survey before they return to work, and confirm whether or not they have Covid-19 symptoms or if they have been in contact with someone displaying symptoms. Workers will also have to undertake induction training to ensure they are up to speed with public health advice. Workplaces will also have to appoint at least one worker representative who will work with the employer to ensure measures are being strictly adhered to.

It’s important to remember the measures in the Return to Work Safely Protocol are separate to the guidelines for social distancing in pubs.

Fáilte Ireland has put together an informative Covid-19 business support section packed full of advice about a range of issues, including business liquidity, managing temporary closure and accessing government supports.

Click HERE to access the site.

I Am Here Programme

Fáilte Ireland, in partnership with PulseLearning, is offering the I Am Here: Rapid Response service to the Irish tourism industry. This is a programme of mental health support and learning within the workplace and beyond to empower employers and employees to have courageous conversations about mental health.

I Am Here recognises that people in your business want to connect with their fellow team members to get the help or support they may need, especially during times of crisis. This programme enables your team members to signpost existing services to those who need it.

To access this service, visit I Am Here

Employee Assistance Programme: Counselling and support

To provide more formal supports to those who need it, Fáilte Ireland has partnered with Inspire Workplaces to offer free and confidential access to an Employee Assistance Programme. This is available widely to business owners, employees and people who are self-employed in the industry.

Inspire Workplaces offers wellbeing supports and counselling services as well as advice on financial concerns and legal issues, and has a wealth of experience of supporting organisations and employees at times of crisis across Ireland.

Through a Freephone Helpline, offered 24/7/365, businesses and employees can access this full range of services:

- Freephone Helpline on 1800 201346: You will need to quote Fáilte Ireland when accessing the service to ensure the services are provided to you free of charge.

- Visit www.inspiresupporthub.org and on the homepage, click the purple ‘Sign Up’ icon, top right. Where prompted, enter your company PIN, which is unique to Fáilte Ireland: COFIHUB!

Employee Wellbeing supports

Fáilte Ireland’s suite of Employee Wellbeing supports aims to help the industry through this difficult time, on both a professional and personal level. “As you know, business owners, employees and people who are self-employed are facing uncertainty about the future of their jobs and businesses. Times like this can naturally cause significant anxiousness and worry. We know that the impact this crisis is having on the mental health and wellbeing of employees is an area of significant concern for employers, with many not currently having the resources to properly engage and help employees.

There are a number of supports available, including a full Employee Assistance Programme offering counselling, financial and legal advice, which is available to the whole industry. The supports can be accessed HERE

Safety Charter

Fáilte Ireland has launched a safety charter aimed at giving consumers confidence to re-engage with the hospitality sector.

According to Fáilte Ireland “The Charter has been created to help businesses boost their tourism trade, by showcasing their commitment to following all recommended safety and cleaning guidelines, and to instil confidence in their customers. By signing up to the COVID-19 Safety Charter, businesses are agreeing that all of their employees will follow our sector-specific guidelines for reopening and undertake the Infection Prevention Control programme being launched as part of this.”

You can access the safety charter application HERE

Insurance agreement

The majority of main insurance companies in Ireland have agreed to reduce premiums and maintain cover for unoccupied premises after extensive lobbying from the VFI and Alliance for Insurance Reform.

After making strenuous representations to the Department of Finance about the insurance sector’s refusal to accept VFI members’ business interruptions claims, the Department has secured an agreement with most of Insurance Ireland’s members to ensure they take a more customer focussed approach when dealing with businesses.

The outcome of this engagement is an agreement from most of the key insurers in the Irish market – namely Allianz, AIG, AXA, FBD, RSA, Liberty Insurance, Travelers Insurance and Zurich – that they will apply the following common measures which will be available to their business customers:

Forbearance

- Insurers will reduce premiums for business customers to reflect reduced level of exposure as a result of Covid-19 restrictions for Employer Liability/ Public Liability and Commercial Motor.

- Insurers will allow up to 28 days after renewal for payment.

Business Premises

- Insurers will maintain cover for unoccupied commercial buildings/ premises not in use due to Covid-19 restriction (for a maximum of 90 days). Appropriate supervision and security of the premises is required.

- Insurers will support requests for a change of property use during the crisis.

NB: Customers wishing to avail of this offer should contact their insurers (or brokers) directly

Arthur Cox & Co

We have been engaging, together with the LVA, with Arthur Cox & Co in respect of the insurance issue. To view a detailed click HERE

Owens McCarthy

As the insurance sector continues to refuse to honour business interruption cover claimed as a result of Covid-19, a professional loss assessor working on your behalf has never been more important.

The VFI is happy to endorse the work of leading assessors, Owens McCarthy, who have represented many publicans over the years with great success.

While there are many people out there purporting to be experts, only trained and professional individuals working in the claims sector can give a valued opinion. That’s where Owens McCarthy comes in.

They offer a professional service within a large organisation that can handle a significant number of VFI member queries. While there are other loss assessors out there, dealing with Owens McCarthy will mean you receive their expertise gained from working on other VFI member policies. There is strength in numbers.

While this is not a partnership with the VFI, we strongly recommend you engage a loss assessor with an excellent track record. Owens McCarthy have spoken at VFI seminars in the past and we have no hesitation in recommending their service. They are happy to work for members on the basis of results achieved rather than upfront payments.

Visit the website at WWW.OWENSMCCARTHY.COM or contact them on 1890 293 949.

Update: October 2021

During Budget 2022 it was announced that a targeted commercial rates waiver in Q4 2021, for business that are not yet fully open, would be introduced.

This means pubs will be exempt from commercial rates for the entirety of 2021.

Background

In March 2020, at the start of the pandemic, the VFI secured confirmation from government that commercial rates for pubs were to be abolished for the duration of the closure caused by Covid-19. This extremely welcome news comes after VFI Chief Executive Padraig Cribben contacted Minister for Finance Paschal Donohue and Minister for State at the Department of Housing, Planning and Local Government, John Paul Phelan about the matter.

In an email to Padraig, the Minister for State wrote: “There’s a lot more detail to be worked out over the coming weeks, but I can assure you that the government has no intention of pursuing commercial rates to be paid for the period Pubs have been asked to close on public health grounds”.

Commercial rates are one of the biggest outgoings for most publicans, so tonight’s news will be of huge relief to members.

Following the confirmation we received two weeks ago that commercial rates for pubs are to abolished for the duration of the crisis, you still must engage with your local authority about this issue.

You should write to your local authority requesting a derogation from rates based on the fact that Minister for State at the Department of Housing, Planning and Local Government, John Paul Phelan, wrote to the VFI stating: “There’s a lot more detail to be worked out….over the coming weeks but I can assure you that the government has no intention of pursuing commercial rates to be paid for the period Pubs have been asked to close on public health grounds”.

Something you may have forgotten but on top of the many challenges you already face, allowing drain networks and connected Grease Traps to dry out during this prolonged period of inactivity will cause problems. This distinct possibility can be averted by the few simple measures outlined below from fog.ie:

With the current enforced closure in place we are offering Publicans some tips, for your staff to carry out during this period, so as to avoid potential problems when you eventually reopen:

1) Regularly run the taps feeding to the Grease Trap several times per week during the current closure.

2) If you already use an approved Dosing Programme reduce to a minimum, but do not fully eliminate, dosing of the Grease Trap.

By taking the above measures you can then keep your drain lines flowing/ prevent anaerobic (smelly) conditions & blockages from forming plus avoiding unwarranted costs of a Pump Out being needed when the system restarts.

They would like to offer support to pubs to help them out in this difficult time. They would be prepared to defer payments on a case by case basis rather than instituting a blanket freeze on payments.

Those members paying for live performances please advise IMRO this is no longer the case. You will need to do this in writing.

The email address is [email protected]

IMRO are taking the following to assist members:

– A DD moratorium for all government enforced closures and voluntary closures (where licensees self declares the closure) that will include all your members to 30th April with the situation to be reviewed and agreed with you again at that point

– Credit notes issued to all premises that have had government enforced closures and voluntary closures (where licensees self declares the closure) up to 30th April with the situation to be reviewed and agreed with you again at that point. Credit notes will be issued once the pubs have re-opened

– We are requesting that rather than cancel direct debits, licensees leave the direct debits in place and the moratorium above will apply

– We also request that, where possible, your members use the IMRO Customer portal HERE

“We (IMRO) are not in a position to refund VFI members for the DD taken last week due to distribution commitments made to IMRO members. The majority of the IMRO membership is somewhat similar to VFI members in that their ability to earn has also been closed down with no possibility to perform in pubs, clubs and hotel bars.

“We will work with you and your members as much as we possibly can through this period and I wish you and your members all the very best during this unprecedented extraordinarily difficult time for them.”

As they cannot refund the dd taken out recently we are working on having a moratorium on the first month back in action as a replacement.

Credit Notes

IMRO will be issuing credit notes to VFI members once the closure orders have been lifted. IMRO strongly advise that all customers sign up for IMRO’s self-service portal. It is the easiest and fastest way to obtain your credit note. Register your account now at the following link HERE

Monday 11th May Update

Due to the current measures, IMRO will be extending the duration of credit notes that will be made available to customers, as well as the direct debit payment holiday until the 31st of May 2020.

In order to obtain a credit note and manage your account online, IMRO request that all customers sign-up to the IMRO Self-Service Licensing portal. Please find the registration link: HERE

This will all be reviewed again before the end of May and a decision on June payments will be taken considering the circumstances at that time. If you require any further information on IMRO’s COVID-19 procedure, please find the customer FAQ HERE

We’ve received general guidelines (see below) from Ecocool in respect of equipment not being utilised during shut down. Best practice is to follow manufacturers/ supplier/ refrigeration contractors and relevant breweries for specific instruction but this fact sheet is a handy reference tool.

On a related health note, please remember to run your taps a few times a week to prevent water stagnation.

To download a printable version of the following click HERE

The following are some general Guidelines received from Ecocool in respect of Equipment not being utilised during shut down.

Best practice is to follow manufacturers/ supplier/ refrigeration contractors and relevant breweries for specific instruction.

Breweries should be contacted for advice on best practice on line cleaning. Your local refrigeration contractor should be engaged to check equipment in advance of reopening to ensure all equipment is at peak performance.

How to Clean Your Bottle Cooler & Turn Off

- Before you begin – ensure your hands and arms are clean to prevent any bacteria entering the cooler. Ensure the cooler is empty.

- Power off the cooler at the mains.

- Spray both the shelves and the interior sides with appropriate cleaning fluid, then rinse thoroughly. Use a clean cloth to dry.

- Spray appropriate cleaning fluid on the hinges and the door runners and wipe clean. These areas are bacteria prone and can cause doors to jam.

- Leave doors open to allow air to freely flow through the cooler while powered down.

Always follow manufacturer’s instructions

How to Clean an Ice Maker

Ice makers’ maintenance requirements will vary from vendor to vendor, but most ice machines follow a similar overall process. Please consult with your machine’s manual for the appropriate procedure, but here are some general steps to clean most ice makers.

- Remove all ice from the bin or dispenser.All ice must be removed during the cleaning and sanitizing cycles. To remove the ice, follow one of the methods below:

- Press the power switch at the end of the a harvest cycle after ice falls from the evaporators

- Press the power switch and allow the ice to completely melt

- Press the “clean” or “wash” button if available.Water will flow through the water dump valve and down the drain. Wait until the water trough refills and the display indicates to add chemicals. This typically takes at least 1 minute.

- Add the recommended amount of ice machine cleanerper your manual.

- Wait until the clean cycle is complete. This will typically take at least 20 minutes. After the cycle is complete, disconnect power to the ice machine (and the dispenser if applicable).

- Remove any internal ice machine components for cleaning.For safe and proper removal, refer to your machine’s manual. Once all parts have been removed, continue to the next step.

- Mix a solution of cleaner and lukewarm water.Refer to your machine’s manual for an appropriate amount of solution. A general water to cleaner ratio is 1 litre of water to 125ml of cleaner. Depending on the amount of mineral build up, you may need to use additional cleaner.

- Use half of the water and cleaner mixture to clean all componentsand parts you’ve removed. Most solutions will start to foam once they come in contact with lime, scale, and mineral deposits. Once the foaming stops, use a soft-bristle nylon brush, sponge, or cloth to carefully clean all parts and then rinse with clean water.

- Use the other half of the water and cleaner mixture to clean all food zone surfacesof the ice machine and bin or dispenser. Use a nylon brush or cloth to thoroughly clean the following ice machine areas: side walls, base (area above the trough), evaporator plastic parts (top, bottom, sides), and the bin or dispenser.

- Rinse all areas with clean water.This will help remove chemicals to prevent ice from becoming contaminated.

Always follow manufacturer’s instructions

Glasswashers/Dishwashers

- Use a good quality detergent to clean out machine by running 4 cycles

- Clean inside with a small brush to get at accrued dirt

- Leave door open and then repeat the process on re-use of machine.

- Also advisable to get local service provider to give a cursory service before re-using.

Always follow manufacturer’s instructions

Beer Cooling Systems

Cold room / Ice Bank systems:

- Turn off Ice Bank and Cold room systems at point of power supply.

- Advisable to clean beer lines and leave dry until further use) need Brewery advice on this point)

Always follow manufacturer’s instruction

LANCER Glycol Systems

- Turn off External compressor/compressors at point of power supply

- Turn off LANCER Glycol tank at power supply

- Turn off Chiller plates at controller under bar counter

- Advisable to clean beer lines and leave dry until further use (need Brewery advice on this point)

- If Bottle coolers on system, please turn off also

- If Food cold rooms on system, please empty all food or call ECOCOOL for advice if you wish to continue to use the Food room.

Always follow manufacturer’s instructions

Heat Pump / Air Con Systems

- Turn off at Power Supply

- Clean Filters if possible

- Get serviced on return to action, incl. external compressor units

Always follow manufacturer’s instructions

Training and advice during Covid-19 crisis

Your Local Enterprise Office

Members should be aware that your Local Enterprise Office offers a range of services to businesses. These services may vary from county to county depending on local needs. The following is a sample of the range of services available at some of the county LEO offices:

How Can Your Local Enterprise Office Help You?

The Local Enterprise Office (LEO) serves as a first stop shop to providing support and services to start, grow and develop micro businesses.

Some supports include:

- Covid19 Business Support

- Covid19 Opportunity Webinar For Food Industry

- Business Continuity Voucher (Worth €2,500 towards third party consultancy)

- Covid19 Business Loan from Microfinance Ireland

- Business Information and advice

- Training Programmes and Events

- Mentoring

- Feasibility, Priming and Business Expansion Grants

- Trading Online Vouchers

- Networking

To access your Local Enterprise Office (LEO) just google the name of your county followed by LEO e.g. Meath LEO or Cork LEO.

Failte Ireland Supports

In response to the COVID-19 crisis and the impact it is having on the tourism sector, Failte Ireland have targeting their business supports to respond to the most urgent challenges and threats tourism businesses are now facing. All of these supports can be accessed by clicking on the following:

Temporary Layoffs and Redundancies

These customised supports will assist you and your team to navigate your business through these extremely challenging times and will be continuously updated as the COVID-19 pandemic evolves.

Fáilte Ireland will focus all of our resources in helping to rebuild the industry and the vital contributions it makes to Irish society.

To view the list of current government supports click HERE

Irish Water’s new non-domestic tariff framework for business customers is to be deferred as a result of the current Covid 19 emergency. The new framework which supports a new national set of charges was due to come into effect on 1 May 2020, with customers due to receive communications about these changes in the coming weeks. This decision has been taken by Irish Water with the support of our economic regulator, the Commission for Regulation of Utilities (CRU), and the Department of Housing, Planning and Local Government.

Irish Water is encouraging businesses to still visit www.water.ie where they can assess the impact of the new charges on their bill using our online calculator tool and case studies. Further information including detailed Q&A is also available online or by visiting www.cru.ie.

Customers who may be experiencing billing or payment difficulties can contact the dedicated business team on 1850 778 778.

It may seem obvious, but your health is more important than anything else. The stress people are feeling right now is perfectly understandable so please ensure you have someone to talk things through. Alternatively, you can call The Samaritans at 116 123 or visit their website: www.samaritans.org

Mental Health Ireland list five key areas we should all concentrate on to remind healthy over the coming period. To view click HERE

This year is very different and it’s important to stay positive about the situation we find ourselves in. Don’t be afraid to pick up the phone and talk to a fellow publican. We know a few of you around the country have made the commitment to call a few fellow publicans every day to see if they’re ok. Now more than ever it’s good to talk.

There’s a great online resource called Lust for Life that is also worth checking out HERE